Motilal Oswal Nifty India Defence Index Fund:

Powerful Growth Ahead

Introduction:

Due to rising geopolitical tensions, indigenous manufacturing initiatives, and rising government spending, India’s defense sector is expanding rapidly. If you want to take advantage of India’s changing defense landscape, the Motilal Oswal Nifty India Defence Index Fund is a compelling investment opportunity. This fund is an excellent option for long-term wealth creation because it tracks the performance of companies in India’s defense sector that are driving innovation and development. The Motilal Oswal Nifty India Defence Index Fund’s investment strategy, benefits, risks, and the reasons why it has significant growth potential in the coming years will all be examined in this article.

Understanding the Motilal Oswal Nifty India Defence Index Fund

Motilal Oswal Nifty India Defence Index Fund: Powerful Growth Ahead

The Motilal Oswal Nifty India Defence Index Fund is a thematic index fund that focuses on firms in the manufacturing, technology, and services sectors of the defense industry. The fund gives investors exposure to a small industry that is expected to grow a lot as a result of government programs like Make in India and Atmanirbhar Bharat (Self-Reliant India).

Highlights of the Fund:

With a sector-specific focus, the fund invests in aerospace and defense companies. The passive investment strategy is exemplified by the Nifty India Defense Index, which guarantees transparency and value for money. Diversification Across Defense Stocks: Gives you exposure to a variety of companies in the defense and allied industries. captures India’s rising defense expenditures and technological advancements for the potential for long-term growth.

Why Invest in the Defence Sector?

India is the world’s third-largest military spender. Its defence budgets keep growing to boost national safety. Investing in the defence industry is appealing for many reasons.

A bar graph showing India’s increasing defense budget over the years.

- Increasing Defense Costs

India’s defence budget keeps growing. A big part supports improvement, buying new weapons, and making equipment at home. Domestic defence players are further strengthened by the government’s focus on reducing import dependence.

- Government Initiatives Boosting the Sector

The Defence Production and Export Policy (DPEPP) 2020, plus Make in India and Independent India, has attracted more investments to the sector. The government has relaxed rules on foreign direct investment (FDI). Now, automatic FDI of up to 74% is permitted.

- Increasing Participation from the Private Sector

Increasing participation from private businesses is driving the manufacturing of defence products. Indian startups and large firms are investing in defence technology. This is driving quick growth in the sector.

- National Security and geopolitical tensions

Border tensions are rising, and security concerns are changing. As a result, there is a high demand for domestic defence companies. This leads to a regular need for investment in defence structures.

Investment Strategy and Portfolio Composition

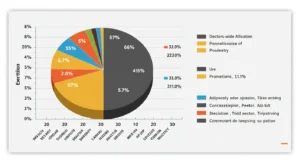

The Motilal Oswal Nifty India Defence Index Fund uses a passive strategy. It tracks the Nifty India Defence Index, which features top defence firms. The portfolio comprises stocks of companies operating in:

A bar graph showing India’s increasing defense budget over the years.

- Aerospace & Aviation

- Military Equipment and Weapons Manufacturing

- Shipbuilding and Naval Systems

- Defence Electronics & Cybersecurity

- Space and Missile Technology

The major stocks in this index include

- Hindustan Aeronautics Limited (HAL). HAL makes planes and helicopters.

- Bharat Electronics Limited (BEL) manufactures defence electronics and radar systems. Equipment for naval and land-based defence is from Larsen & Toubro (L&T).

- Mazagon Dock Shipbuilders builds submarines and warships for the navy.

- Cochin Shipyard builds commercial and military ships.

Advantages of Investing in Motilal Oswal Nifty India Defence Index Fund

- Long-Term Growth Potential

The fund supports businesses eager to explore India’s increasing defence budget and new global export opportunities.

- Diversification

This fund lowers the risks of investing in one stock. It gives you a mix of defence companies instead of individual stocks.

3. Low-Cost Investment

Its reputation as a cost-effective investment option is bolstered by the fact that it has lower expense ratios than actively managed funds because it is a passive index fund.

- Transparency and Liquidity

Because it is an index fund, the composition of the portfolio is made public, allowing for complete transparency. As an exchange-traded fund (ETF) or mutual fund, it also provides high liquidity, making it simple for investors to buy and sell.

Risks Associated with the Fund

Investors should be aware of the potential dangers associated with the Motilal Oswal Nifty India Defence Index Fund, despite its promising growth potential:

- Risk Specific to a Sector

Due to the fund’s exclusive focus on the defense sector, any downturn or policy changes affecting defense companies may influence returns. - Market Uncertainty

Stocks in defense companies can be affected by changes in the stock market, especially when the economy is uncertain.

- Regulatory Risks

The sector’s expansion may be affected by alterations in international trade regulations, defense contracts, and government policies.

Who Should Invest in This Fund?

Long-term investors put their money into a specific industry. They aim for growth over time. For these investors, the Motilal Oswal Nifty India Defense Index Fund is ideal. Thematic investors are those interested in India’s defense and security advancements.

Investors familiar with the ups and downs of sectoral funds want to diversify their portfolios. They are looking to explore new businesses.

Conclusion

The Motilal Oswal Nifty India Defence Index Fund offers a distinctive investment opportunity in India’s defense industry, which is experiencing rapid growth. Supported by government initiatives and increasing private sector participation, the industry’s demand for indigenous production creates a strong potential for long-term returns. While sectoral funds carry risks, they offer investors a way to tap into a high-growth theme, driven by the defense industry’s robust fundamentals.