How Many of Me? Money, Identity, and Financial Success

How Many of Me? Money, Identity, and Financial Success

Have you ever asked yourself, how many versions of me there are when it comes to money? Your financial identity is a key determinant of your wealth, spending behavior and overall financial health. There are those who consider themselves destined to be rich while others consider they will always be poor. Such beliefs are not only reflected in your bank account; they determine your financial life. How Many of Me

Money is not just a means of exchange; it is a central aspect of identity and social standing. You may see yourself as rich, poor or average this defines the financial decisions you make in your day to day life. The problem is not that you are not working hard or even that you are not saving enough but that you have not changed your financial identity.

This article will help you understand the relationship between money and identity, how to change your financial mindset, and how to take charge of your financial life.

The link between identity and money

Money is not only about numbers in the bank, it is about how much we value ourselves. If you think you are the failing financial type, then you will act in a manner consistent with that belief. If you believe you are financially successful then you will do all it takes to build wealth.

How Many of Me? Money, Identity, and Financial Success

According to psychologists, our financial behaviors are developed in childhood. If you were raised in a house where money was always a problem then you may have what is called a scarcity mindset – the fear that there will never be enough. This can lead to not only not spending the money, or not investing it, but also to very conservative financial decisions.

However, if you were raised in a family where money was not an issue, you may have what is called a growth mindset, the belief that wealth is available to those who make wise decisions and take reasonable risks. To alter your financial situation, you must stop and consider what you currently think about money and identity. Are you still conforming to wrong perceptions about money?

Your Financial Identity: Who is There With You in the Financial World?

We are all financial identities; you either know it or not. Your financial identity is the way of habits, beliefs and attitudes towards money. Here are some common financial identities:

The Saver: Has a phobia of losing money and does not invest a lot of it.

The Spender: The spender is a spender, but this is accompanied by financial discipline.

The Investor: The wealth is accumulated through investment as a central principle.

The Avoider: This ignores financial matters and this has consequences of long term problems.

Which one are you? Knowing your financial identity is a first step to understanding your money and your financial decisions.

How Limiting Money Beliefs Are Keeping You From Success

It is estimated that many people are self-sabotaging their financial success without their knowledge through beliefs. These include:

‘The root of all evil is money’.

I’ll never be rich.

Greedy rich people.

I’m just not good with money.

Such beliefs cause psychological barriers that hinder financial development. For instance, if you believe that money is evil, you may seek to avoid it. If you believe you will never be rich, you will not undertake what is required to become rich.

To overcome limiting beliefs:

Recognize the negative thoughts you have about money.

Challenge them with logic. (Is there real evidence that money is evil, and you can never be rich?)

Replace them with positive beliefs. (Money is a way of freedom and opportunity.)

Do things that will help you change your mindset. (Investing, financial literacy goals.)

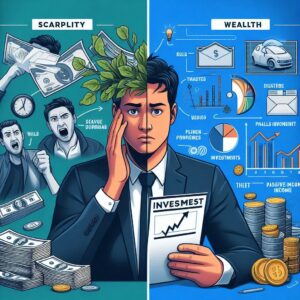

The Wealth Mindset vs. The Poverty Mindset

The Wealth Mindset vs. The Poverty Mindset: Which one you have and why it matters.

It is your money mindset. How Many of Me

A poverty mindset is characterized by survival, fear of risks and belief that wealth is not attainable.

How Many of Me? Money, Identity, and Financial Success

How Many of Me

Wealth mindset is all about identifying opportunities, development and the belief that money can be made.

People with a poverty mindset are likely to say:

“I can’t afford it.”

“Money doesn’t grow on trees.”

“I’ll never be successful.”

People with a wealth mindset will often say:

“How can I afford it?”

“Money is abundant for those who seek it.”

“I am in control of my financial future.”

When you switch your mindset from poverty to wealth, you start to look at financial possibilities instead of deficits.

Money and Self Esteem: The Dangers of the Link

Self-esteem should not be tied to net worth, as this belief devalues individuals based on their financial status and can lead to stress and irrational behavior. It’s important to cultivate talents and virtues beyond money, appreciate oneself regardless of financial circumstances, and set personal financial goals that reflect individual values rather than societal expectations.

Financial Success: Hard Work or Opportunity?

Most people think that wealth is only attained through hard work. While hard work is important, it is not the only way.

Financial success is also influenced by:

This is where opportunities come in – time, place, and network. This is where education and knowledge come in – knowledge of investments, budgeting, business This is where risk-taking comes in – good financial risk-taking yields higher returns This is where the mindset and the strategy come in – the right financial decisions.

Multiple Income Streams: The Key to Financial Growth

Living from a single source of income is risky. The wealthy are well aware of the benefits of diverse sources of income: Investments (stocks, real estate, businesses), side businesses, freelancing or consulting, passive income (royalties, online businesses, dividends). Developing several streams of income is a way of achieving financial stability and long-term wealth.

Financial Freedom vs. Financial Security

Financial freedom and financial security are often used interchangeably, but they are not the same thing. Financial security is the ability to afford one’s living needs while financial freedom is the ability to control how one wants to live life. Which one should you aim for? Both, of course. First, security (saving, budgeting, stable income) and then freedom (investing, passive income, wealth-building strategies). How Many of Me

How to Overcome Fear of Financial Success

How Many of Me? Money, Identity, and Financial Success

Yes, there are some people who are scared of success. They fear:

Others’ opinions (“Who do you think that you are to be rich?”)

Responsibility (“What if I lose all I have?”)

Transformation (“Will wealth alter me?”)

To overcome this fear:

A. Recognize that financial success is your birthright, not a favor.

B. Hang out with people who are financially free.

C. Financial literacy should not be taken for granted.

D. There is nothing to fear about success; it is something to welcome.

Conclusion

Your financial identity is a key determinant of your financial status in the future. Whether you consider yourself wealthy or poor, or stand someplace between the two, you will believe it and act on it.

How Many of Me To become financially successful: Discover and eliminate negative money thought patterns. Build a wealth mindset. Create multiple streams of income. Don’t equate your self-esteem with your bank account. Fulfill your financial goals without any second thought. It’s not a mystery that money is one of the most significant aspects of our lives. The more so, the more you should alter your perception of who you are in relation to money.

FAQs

1. Can changing my mindset really improve my financial situation?

2. What is the biggest mistake people make with money?

3. How do I stop fearing financial success?

4. How do I develop multiple streams of income?

5. Is financial success only for the lucky?